COVID-19 is accelerating the digital shift in Malaysia. The Malaysia Digital Economy Corporation has announced the Malaysia 5.0 project while the latest research by GlobalData shows the rapid adoption of digital payments and e-Commerce.

Malaysia Digital Economy Corporation (“MDEC”) is tasked with organising and leading Malaysia’s Digital Economy forward. MDEC has recently announced Malaysia 5.0, which can contribute to a more sustainable and circular economy by building this national digital ecosystem with a unified alliance of stakeholders both within government and across private enterprise to enable business and societal migration to the digital age.

“Malaysia 5.0 will address financial inclusion, access, performance and growth through the 4th Industrial Revolution (“4IR”) tools such as Fintech, Blockchain and AI. Digital network hubs will emerge as core components of every country’s digital infrastructure, facilitating the interoperability of goods and services that flow through them with interconnectivity between such hubs,” recently said Rais Hussin, Chairman of Malaysia Digital Economy Corporation (“MDEC”) in a recent article published by citiesabc.

And the shift is being accelerated by recent developments. As GlobalData has found, the COVID-19 pandemic has disrupted consumer payment space in Malaysia as consumers are gradually switching from offline to online purchases. The closure of physical stores due to lockdown and social distancing measures led consumers to ramp up online shopping, which in turn accelerated the e-commerce market growth in Malaysia.

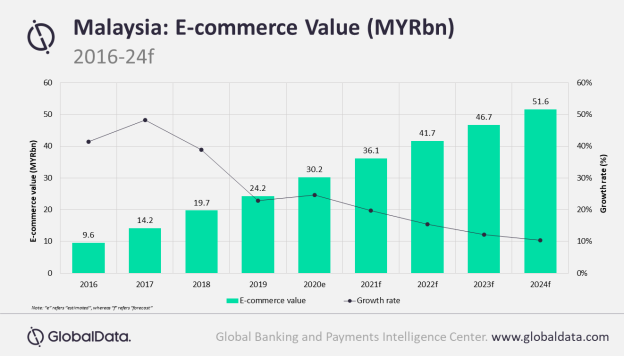

According to GlobalData’s E-Commerce Analytics, Malaysia’s e-commerce market is estimated to register 24.7% growth in 2020. The market is expected to reach MYR51.6bn (US$12.6bn) by 2024, increasing at a compound annual growth rate (CAGR) of 14.3% between 2020 and 2024.

Nikhil Reddy, Banking and Payments Analyst at GlobalData, comments: “Malaysia is among the fastest-growing e-commerce markets in Southeast Asia, driven by rising Internet and smartphone penetration, growing middle class population and tech-savvy millennials. The fear of virus spreading through cash handling and visiting physical stores amid COVID-19 outbreak has further accelerate this growth.”

The government launched a three-month campaign in June 2020 with a budget of MYR140m (US$34.2m) to drive e-commerce adoption among small merchants and help widen their reach across the country.

According to GlobalData’s 2020 Banking & Payments Survey, in Malaysia payment cards is the most preferred payment method for e-commerce purchases, accounting for 40.3% share by value in 2020. Alternative payment methods are also gaining prominence with combined market share of 25.3%. While this space is mainly driven by domestic players, international payment solutions like Google Pay, Masterpass and Visa Checkout are gaining popularity.

Mr Reddy concludes: “The Malaysian e-commerce market has been registering growth during the last few years, which has been further accelerated by the COVID-19 pandemic. This, coupled with the growing consumer preference for online shopping, availability of customized online payment options and government support, will further drive e-commerce market in Malaysia.”

Malaysia 5.0 is a golden opportunity to put the country into the heart of Digital ASEAN. The potential for early adopter countries is to take the lead is further facilitated as round-the-clock transactions become easier, cheaper and more secure with a global reach.